Option Trading Explained: Meaning, Types, and Key Concepts

Team Sahi

Option trading is a derivative trading method that allows traders to participate in market movements without buying or selling shares directly. By using option contracts, market participants can gain exposure to stocks or indices at a fixed price before expiry, making option trading a widely used tool for risk management, capital efficiency, and structured market participation in India.

At its core, an option is a contract that gives the buyer the right, but not the obligation, to buy or sell an asset at a fixed price before a specified expiry date. This “choice” is what makes options powerful.

It allows traders to benefit from price movements and step aside when conditions are unfavourable. Options are not just a trading instrument. They are a risk-structuring tool used by professional traders, institutions and hedgers across global markets.

How does Option trading work?

Option trading involves buying or selling option contracts whose value is derived from an underlying asset such as a stock or an index. Instead of owning the asset, traders use these contracts to express a market view.

An option contract gives the buyer:

- The right, but not the obligation.

- To buy or sell an underlying asset

- At a predefined price

- On or before a specific expiry date

If the market does not move favourably, the option buyer can let the contract expire. This ability to participate without commitment is what differentiates option trading from direct equity trading.

Call Options and Put Options Explained

Options are classified based on the type of right they provide.

Call Option

A call option gives the buyer the right to buy the underlying asset at a fixed price before expiry.

Put Option

A put option gives the buyer the right to sell the underlying asset at a fixed price before expiry.

Call Option vs Put Option

| Option Type | What It Means | When Traders Use It |

|---|---|---|

| Call Option | Right to buy the asset | When expecting prices to rise |

| Put Option | Right to sell the asset | When expecting prices to fall |

Let’s understand with an example:

Suppose Nifty is currently trading at 25800, and you choose a 26000 strike option expiring on 25 March 2026.

- A Call Option allows you to lock the right to buy the NIFTY 26000 contract at at premium of ₹180 on 25 March 2026.

- A Put Option allows you to lock the right to sell the NIFTY 26,000 at a premium of ₹170 on 25 March 2026.

Key Option Trading Terms You Must Know

Understanding option trading requires familiarity with the basic components of an option contract.

Strike Price

When you trade options, you don’t directly bet on “buy” or “sell” the market. You first choose a strike price a specific level and then take a view around that level. In simple terms, you are saying:

- “I think the market can move above this level,” or

- “I think the market can move below this level.”

You use the strike price as a comparison point against the current market price to judge:

- How far the market needs to move

- Whether your option can become profitable

- And how sensitive your premium will be

This is why the strike price is called the reference level of the option contract. It decides:

- When your option becomes profitable

- How much intrinsic value it carries

- How your premium moves

In this example, 26,000 is the strike price the level you are using to compare Nifty’s current price and take your directional view.

Premium

The premium is the price you pay to purchase the option contract. It is the entry cost of your trade and also the maximum loss you can face as an option buyer.

In the example above, ₹180 (Call) and ₹170 (Put) are the premiums paid to buy the option.

Expiry Date

Every option contract has a limited life. The expiry date is the last day on which the contract is valid. After this, the option settles and becomes worthless if not profitable.

In the example above, 25 March 2026 is the expiry date of the option contract.

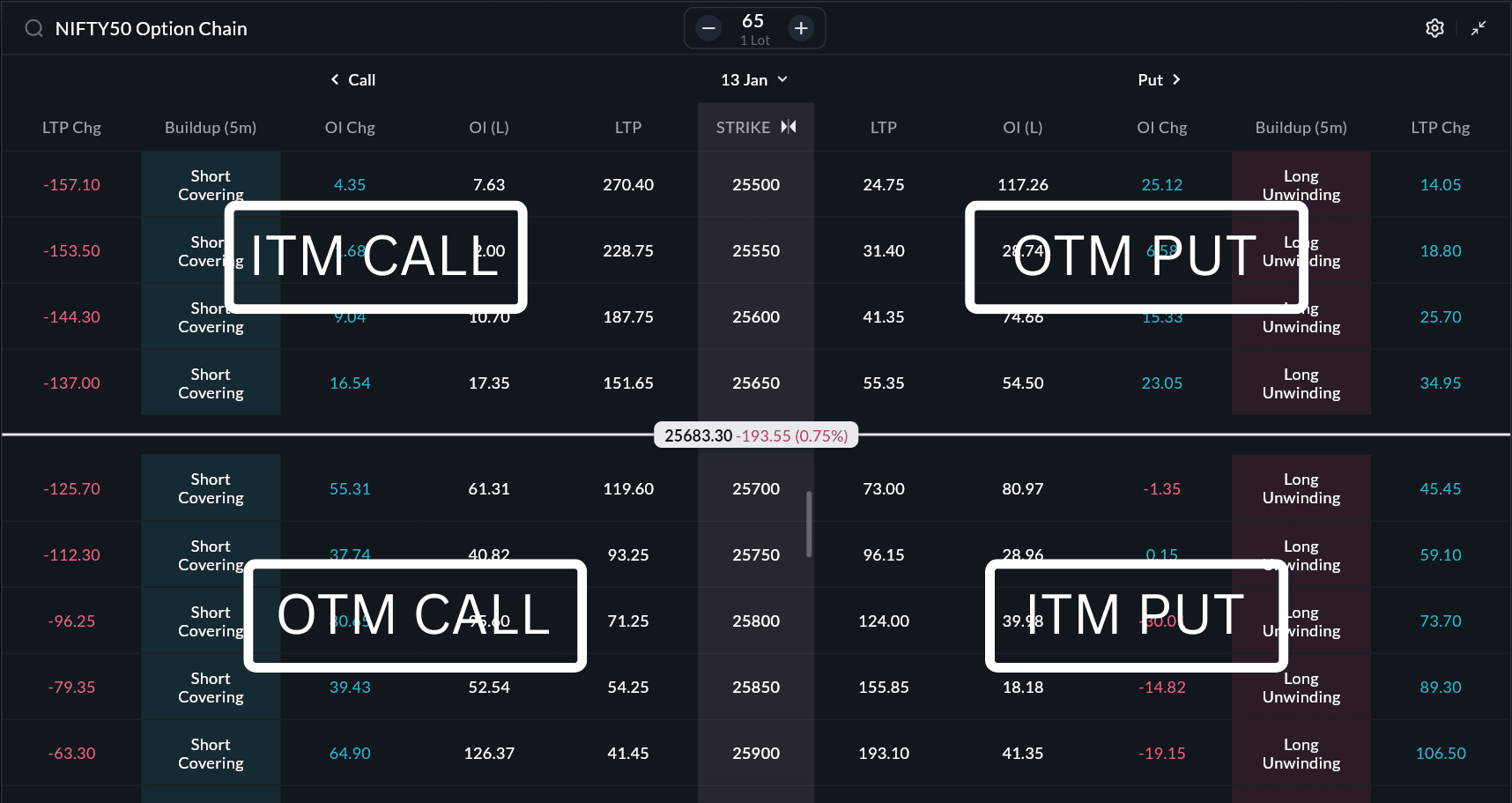

Understanding Option Moneyness: In-The-Money (ITM), At-The-Money (ATM) & Out-Of-The-Money (OTM)

Now that you understand strike price, premium and expiry, the next natural question is:

Which option should you buy or sell? And how do you know whether an option already has value or needs the market to move?

This is where the concept of moneyness comes in. Moneyness simply describes how close an option is to being profitable if it were exercised today.

It compares the option’s strike price with the current market price of the underlying asset and tells you whether the option already has real value or is still waiting for the market to move.

In-The-Money (ITM)

An option is In-The-Money when it already has real, usable value.It is called ITM because if you exercised the option today, it would result in a profit.

- A Call option is ITM when the market price is above the strike price

- A Put option is ITM when the market price is below the strike price

Example:

If Nifty is trading at 27,000, a 26,000 Call is ITM because you have the right to buy lower and sell higher making it immediately profitable.

ITM options are more expensive but also more stable because they already carry intrinsic value.

At-The-Money (ATM)

An option is ATM when the strike price is close to the current market price. These options are among the most actively traded due to their sensitivity to price movement.

Example:

If Nifty is at 26,020, the 26,000 strike is considered ATM.

Out-Of-The-Money (OTM)

An option is OTM when it has no intrinsic value and requires further market movement to become profitable.

- A Call option is OTM when the market price is below the strike price

- A Put option is OTM when the market price is above the strike price

Example:

If Nifty is at 25,200, a 26,000 Call is OTM.

OTM options are cheaper but riskier, because their profitability depends entirely on future market movement.

Types of Options in the Market

Options (in India) differ based on what they track and how they settle.

1. Based on the Underlying Asset

Equity Options (Stock Options)

These options are linked to individual listed companies. In India, stock options are physically settled, meaning share delivery obligations apply if positions are held until expiry.

Index Options (Most Actively Traded)

Index options are based on market indices rather than individual stocks. Commonly traded Indian index options include Nifty 50, Bank Nifty, Fin Nifty, and Sensex. Traders prefer index options because of:

- Higher liquidity

- Lower manipulation risk

- Cash-settled (no delivery risk)

- Ideal for intraday and expiry trading

| Index | What It Represents |

|---|---|

| Nifty 50 | Top 50 Indian companies |

| Bank Nifty | Banking sector |

| Fin Nifty | Financial services |

| Sensex | BSE’s benchmark index |

ETF Options

ETF options track Exchange Traded Funds such as:

- Gold ETFs

- Bank ETF

- Nifty ETF

They are primarily used by institutions and long-term investors for portfolio hedging and asset allocation protection. However, ETF options are currently not actively available for retail trading in Indian markets.

2. Based on Settlement Type

| Settlement | What It Means |

|---|---|

| Cash Settlement | Profits/losses adjusted in cash (Index options) |

| Physical Settlement | Delivery of shares (Stock options) |

This difference is critical for margin planning and risk control.

Why Traders Use Options Trading

Options are not just “cheap lottery trades”. Option trading is used for multiple purposes beyond short-term speculation.

Capital Efficiency

Options allow traders to control market exposure with lower capital compared to buying stocks outright, enabling better allocation of available funds.

Defined Risk

For option buyers, the maximum possible loss is known in advance and limited to the premium paid. This makes risk easier to measure and manage.

Portfolio Hedging

Options are widely used to protect portfolios during market declines. Protective positions can reduce downside impact and stabilise returns.

Income Structuring

Certain option structures allow traders to earn premium income in range-bound markets, making options usable across different market conditions.

Popular Beginner Options Trading Strategies

Options are typically used through predefined strategies rather than isolated trades.

Long Call

Used when expecting prices to rise. Loss is limited to the premium paid, while potential gains increase as prices rise.

Long Put

Used when expecting prices to fall or to protect against downside risk.

Covered Call

Involves holding shares while selling a call option to generate income.

Protective Put

Used to limit losses on an existing stock position during market declines.

Risks & Risk Management in Options Trading

Options trading is powerful but it is not risk-free. Most beginners lose not because of bad predictions, but because of poor structure and uncontrolled leverage. Understanding risk is what separates consistent traders from gamblers.

Key Risks in Options Trading

Time Decay (Theta Risk):

Options lose value daily. Even if the market moves slowly in your direction, your premium can still fall.

Volatility Risk

Sudden drops in implied volatility can reduce option prices sharply, even when price direction is correct.

Leverage Risk

Options provide high exposure with low capital.Without proper sizing, losses can accumulate quickly.

Option Selling Risk

Unstructured option selling can involve large margin and potentially unlimited losses.

Risk Management Principles

| Principle | Why It Matters |

|---|---|

| Defined-risk strategies | Limits losses before trade entry |

| Position sizing | Prevents account blow-ups |

| Stop-loss discipline | Protects emotional capital |

| Avoid overtrading | Preserves long-term survival |

In options trading, capital protection is more important than profit generation.

Options trading with Sahi

Options trading is not about speculation alone. It is a risk-structuring and capital-efficiency tool used by professional traders, institutions and portfolio managers across global markets.

When applied with discipline, defined-risk strategies and proper execution, options allow traders to:

- Protect capital

- Generate income

- Trade with lower capital blockage

- Remain consistent across all market cycles

Sahi is built specifically to support option traders with faster execution, intelligent risk tools, deep option chain insights and strategy-friendly workflows helping traders trade with clarity rather than chaos.

Related

Recent

SGX Nifty: What It Is, How to Track It and Its Rebrand as GIFT Nifty

India VIX: What the Volatility Index Measures and How Traders Use It

Sensex Index: What It Is, How It Is Calculated and How It Compares to Nifty 50

SEBI’s AI Tool ‘Sudarshan’: The End of “Expiry Income” Content?

Iran–Israel Conflict: The Middle East Risk Your Portfolio Isn’t Pricing In