ICICI Prudential AMC IPO Opens Today: What the ₹10,600-Crore OFS Means for Investors

Team Sahi

India’s asset management industry is getting one of its most closely watched listings this year. ICICI Prudential Asset Management Company (AMC) opened its initial public offering today, December 12, 2025, marking one of the largest IPOs in the domestic financial services space in recent times.

The IPO is a pure offer-for-sale (OFS) by promoter Prudential Corporation Holdings Ltd, aggregating to approximately ₹10,600 crore, with no fresh capital being raised. The shares are slated to list on BSE and NSE on December 19, 2025.

Here’s a detailed breakdown of what the IPO offers, how the business stacks up financially, and what market sentiment currently signals.

ICICI Prudential IPO Snapshot: Key Details at a Glance

| Particulars | Details |

|---|---|

| Issue Type | Pure Offer for Sale |

| Issue Size | ~₹10,600 crore |

| Price Band | ₹2,061 – ₹2,165 per share |

| Lot Size | 6 shares |

| Minimum Retail Investment | ~₹12,990 |

| Shares on Offer | 4.90 crore shares (≈9.9% equity) |

| Implied Valuation (Upper Band) | ~₹1.07 lakh crore |

| Listing Date | December 19, 2025 |

| Exchanges | NSE, BSE |

IPO Timeline: From Anchors to Listing

Anchor Investor Bidding: December 11, 2025

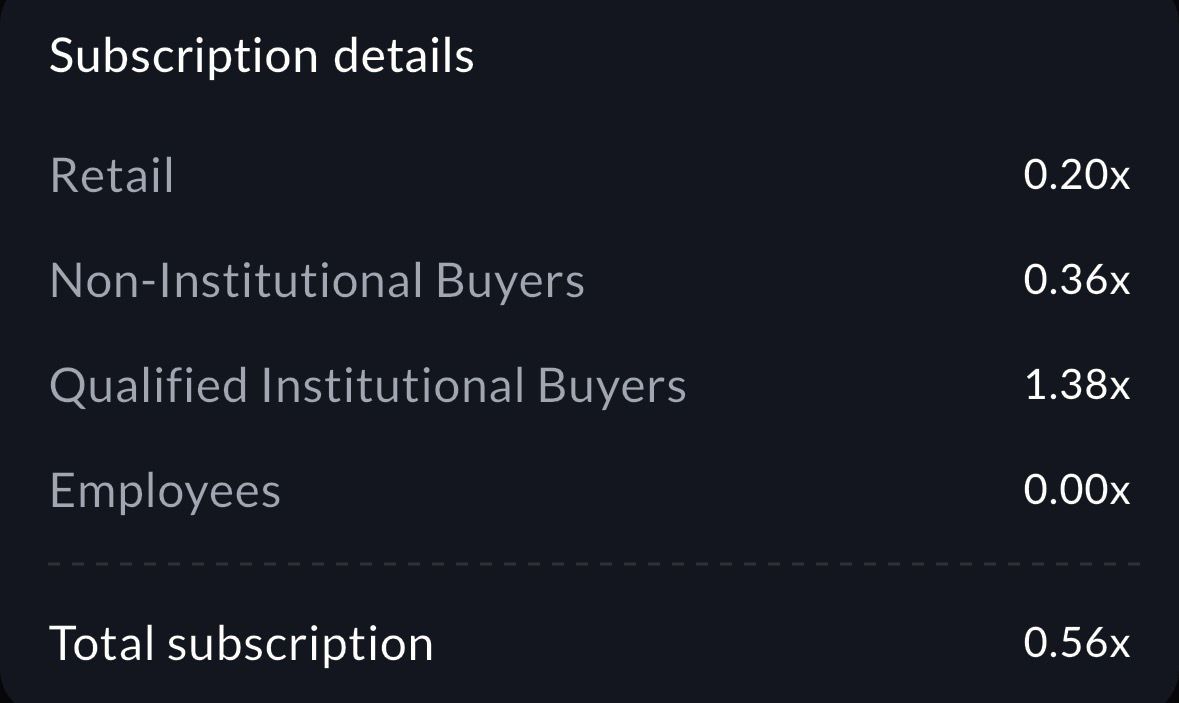

₹3,021.8 crore raised from 149 anchor investors, indicating strong institutional interest ahead of the issue.

Public Subscription: December 12 – December 16, 2025

Basis of Allotment: December 17, 2025

Demat Credit: December 18, 2025

Listing: December 19, 2025

A notable feature of the issue is the reservation of up to 24.48 lakh shares for eligible ICICI Bank shareholders, offering an additional participation incentive to existing group investors.

Business Overview: A Leader in Indian Asset Management

ICICI Prudential AMC is one of India’s largest and most profitable mutual fund houses, jointly promoted by ICICI Bank and Prudential Plc (UK). The AMC has built a strong franchise across:

- Equity and debt mutual funds

- Hybrid and passive products

- Institutional and retail asset management

As of September 2025, the company reported an AUM of ₹10.88 lakh crore, placing it firmly among the industry leaders.

The business benefits from:

- A strong parentage and brand recall

- Deep penetration in retail and institutional segments

- A scalable, fee-based model with high operating leverage

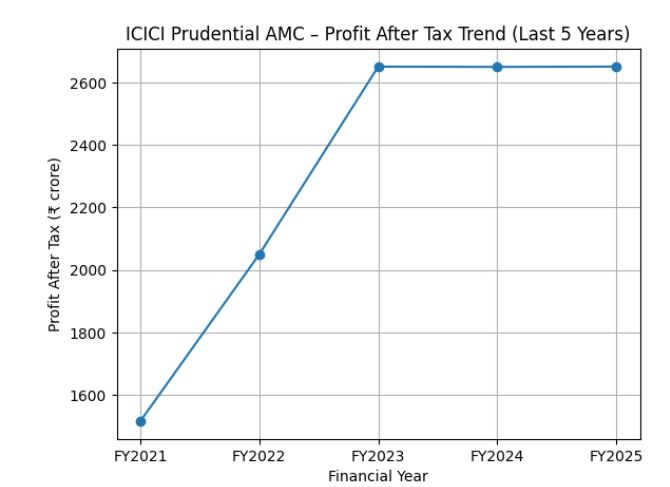

Financial Performance: Strong Growth with Exceptional Profitability

FY25 Performance (Year Ended March 2025)

Revenue: ₹4,979 crore (↑32% YoY)

Profit After Tax (PAT): ₹2,651 crore (↑29% YoY)

Return on Equity (ROE): 82.8%

FY26 Performance (April–September 2025)

Revenue: ₹2,950 crore (↑20% YoY)

PAT: ₹1,618 crore (↑22% YoY)

Source:RHP Document

The numbers underline the capital-light nature of the AMC business. With limited balance-sheet risk and strong fee income, profitability remains consistently high even across market cycles.

Few listed Indian financial companies operate at ROE levels above 80%, making ICICI Prudential AMC stand out on pure return metrics.

Valuation: Is the Pricing Reasonable?

At the upper end of the price band, the IPO values the company at roughly:

~40× FY25 earnings

While the valuation may appear expensive at first glance, market participants argue that the pricing is supported by ICICI Prudential AMC’s market leadership, strong brand franchise, and consistently high profitability. According to coverage in The Economic Times and Business Today, analysts have highlighted the company’s predictable, annuity-like cash flows, superior margins, and capital-light business model, which warrant a premium valuation. Media reports have also pointed to structural growth tailwinds from India’s rising mutual fund penetration and the long-term financialisation of household savings, which provide strong earnings visibility over the medium to long term.

When benchmarked against global asset management peers and domestic listed AMCs such as HDFC AMC and Nippon Life AMC, commentary from The Economic Times, NDTV Profit, and BloombergQuint broadly describes the IPO pricing as “fair to reasonable” rather than aggressive, noting that the multiple is largely in line with sector leaders and reflects business quality, scale, and return metrics rather than speculative exuberance.

ICICI Prudential AMC IPO: Grey Market Premium (GMP) & Market Sentiment as of December 12, 2025

Current GMP: ₹230–₹250 over the upper price band

Implied Listing Gain: ~10-11%

Analyst commentary remains largely positive, with most brokerages assigning a “Subscribe” rating, particularly for long-term investors seeking exposure to India’s financialisation theme.

Key Positives

- Strong and consistent profitability

- Industry leadership with scale advantage

- Capital-light, high-ROE business model

- Structural tailwinds from rising financial savings

- Strong anchor book participation

Key Risks to Track

- Market-linked earnings volatility during prolonged downturns

- Regulatory changes impacting TERs(Total Expense Ratio) or fund structures

- Increasing competition from passive and low-cost products

Bottom Line: Should You Consider the IPO?

For long-term investors looking to participate in India’s expanding asset management ecosystem, this IPO presents a credible, well-priced opportunity. Short-term investors, meanwhile, may temper expectations, as the current GMP suggests modest rather than spectacular listing gains.

As always, allocation should be aligned with portfolio objectives and risk appetite.

Related

Recent

SEBI’s AI Tool ‘Sudarshan’: The End of “Expiry Income” Content?

Iran–Israel Conflict: The Middle East Risk Your Portfolio Isn’t Pricing In

Zomato Share Price Falls for 8 Straight Days. What's Really Going On?

Why Holi Flight Prices in 2026 Are Up 185% — And What's Really Behind the Surge

MCX Gold: Meaning, Contract Details, Trading Rules and Outlook in India