What Caused Axis Bank to Fall 5% Today?

Team Sahi

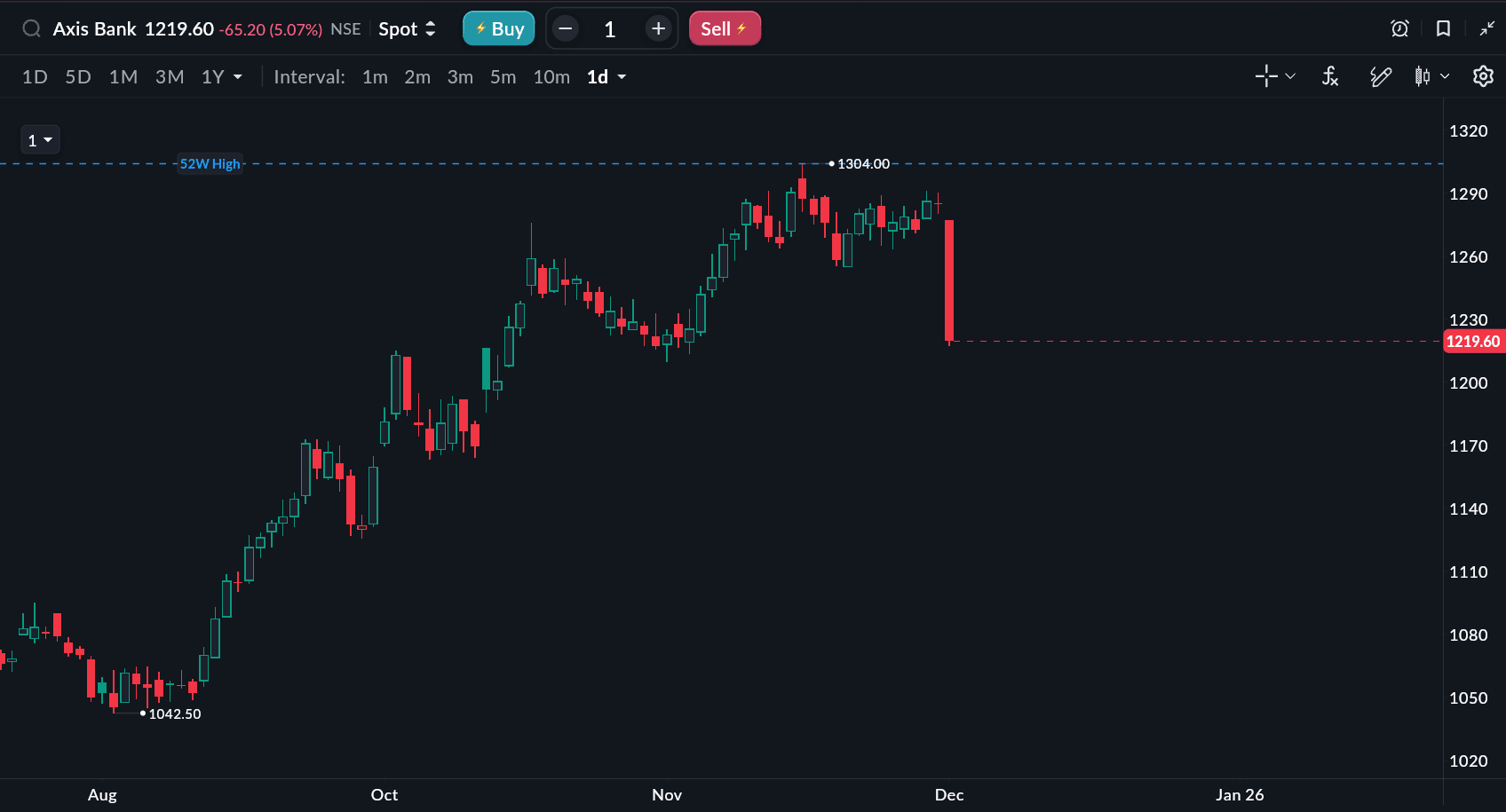

Axis Bank share price fell nearly 5% today (December 16), emerging as the biggest drag on the Nifty Bank index after Citi Research warned that the bank’s net interest margin (NIM) recovery is likely to be delayed. The revised margin outlook dampened investor sentiment, triggering sharp selling in the stock during morning trade.

Axis Bank shares slipped to the ₹1,220–₹1,230 range, down from a previous close near ₹1,285, while Bank Nifty declined about 0.6% to trade around 59,107.

Why Did Axis Bank Share Price Fall Today?

The sharp decline in Axis Bank shares was triggered by a cautious note from Citi Research, which highlighted that the lender’s management now expects net interest margin (NIM) recovery to be pushed back. This concern is magnified by the fact that Axis Bank’s NIM has already softened from the ~3.9–4.0% range seen in early FY25 to about 3.73% in Q2 FY26, reflecting sustained cost-of-funds pressure.

This shift in outlook disappointed the market, as margins are a key driver of profitability and valuation for banking stocks. With NIMs already below recent peaks, any further delay in recovery directly impacts earnings visibility, making even a modest timeline extension a meaningful negative for investor sentiment.

Citi maintained its ‘Neutral’ rating on Axis Bank with a target price of ₹1,285, implying limited upside from the stock’s previous closing levels a key factor behind today’s sell-off.

What Did Citi Say About Axis Bank’s NIM Outlook?

According to Citi Research, Axis Bank’s management now expects a shallow, ‘C-shaped’ NIM recovery, with margins gradually improving toward a target of around 3.8% over the next 15–18 months.

Key takeaways from the report:

NIM pressures are expected to persist longer than earlier anticipated

Margin recovery will be gradual, not sharp

Optimisation of the fee-to-asset ratio remains constrained in the near term

Axis Bank reported NIM of about 3.73% in Q2 FY26, and the delayed recovery timeline has increased uncertainty around near-term earnings growth.

Business and Asset Quality: Mixed but Largely Stable

While margin concerns dominated today’s market reaction, Citi’s commentary on underlying business trends was relatively balanced.

Positive observations:

- Corporate lending is showing improved traction

- Retail demand is recovering, supported by pent-up consumption

- Credit card stress is easing

- Personal loan portfolio is stabilising

- Export-oriented MSMEs show no signs of stress

However, Citi cautioned that:

Gross slippages could see seasonal volatility in Q3 FY26, mainly from the agricultural segment’s cash credit (CC) and overdraft (OD) facilities

While this is expected to be less severe than Q1 FY26, it remains a short-term risk to monitor

How Axis Bank’s Fall Impacted Bank Nifty Today

Given Axis Bank’s heavyweight position in the Bank Nifty where it carries an approximate weight of 8.11% the stock’s sharp decline had a visible impact on the broader banking pack. With the index currently trading near 59,000, down about 0.81%, the nearly 5% fall in Axis Bank alone contributed meaningfully to the day’s weakness in the banking index.

Other banking stocks trading lower included:

- Bank of Baroda

- Canara Bank

- Punjab National Bank (PNB)

- IDFC First Bank

These stocks fell close to 1% each, reflecting broader caution across the sector.

Meanwhile, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, State Bank of India (SBI), IndusInd Bank, Federal Bank, and AU Small Finance Bank were also trading in the red, though with relatively modest losses.

No Operational Issues Behind the Decline

Importantly, today’s fall in Axis Bank shares was purely driven by fundamentals and analyst commentary.

No outages were reported for internet banking or the mobile app

Axis Bank’s digital platforms remained fully operational

Recent past technical issues were unrelated to today’s market move

This confirms that the stock reaction was not linked to any service disruption.

What Should Investors and Traders Do Now?

For market participants, Axis Bank’s sharp move underscores the importance of earnings visibility over headline growth.

Short-term traders may continue to see volatility as the market digests the revised NIM timeline.

The ₹1,200–₹1,220 zone acts as an immediate support area, while ₹1,285–₹1,300 remains a near-term resistance.

Long-term investors may prefer to track margin trends and management commentary over the next few quarters before reassessing valuation comfort.

Axis Bank’s nearly 5% fall today reflects investor disappointment over the delay in net interest margin recovery, despite largely stable asset quality trends. Until there is greater clarity on margins, the stock is likely to remain range-bound.

Related

Recent

SEBI Regulation Margin Benefit Calendar: Expiry-Day Change for Single-Stock Spreads

RBI MPC February 2026: Repo Rate Held at 5.25% as RBI Prioritises Stability Over Fresh Easing

Indian Oil Q3 FY26 Results: Strong Earnings Momentum Driven by Refining Upswing and Government Support

Nykaa Q3 FY26 Results: Net Profit Surges 143% YoY to ₹63.3 Crore; Revenue Grows 26.7% to ₹2,873 Crore

PVR INOX Q3 FY26 Results: Reports Net Profit of ₹96 Crore; Revenue Jumps 9.7% YoY to ₹1,908 Crore