Nifty50 Holds 26,100 Despite ITC Drag as Auto Stocks Support

Team SAHI

Nifty: 26,146.55 ▲ +0.06%

Sensex: 85,188.60 ▼ -0.04%

Bank Nifty: 59,711.55 ▲ +0.22%

Market Today: Nifty holds 26,100 despite ITC drag, What’s next?

Markets kicked off the new year on a cautious note, with Nifty managing to hold above the 26,100 mark. Bank Nifty outperformed, as buying interest in financials helped cushion the broader market, while overall market breadth remained mildly positive.

From a structural perspective, 26,200 for Nifty and 85,400 for Sensex are emerging as immediate hurdles. Holding above 26,000 keeps Nifty’s near-term structure intact.

Bank Nifty continues to remain relatively better placed, with 60,100 standing out as the key resistance after today’s resilient showing.

Key Levels to Watch for January 02, 2026

| Index | Support | Resistance |

|---|---|---|

| Nifty | 26,080 & 25,980 | 26,225 & 26,325 |

| Bank Nifty | 59,500 & 59,250 | 59,800 & 60,100 |

| Sensex | 85,000 & 84,650 | 85,475 & 85,850 |

Sector & Stock Moves: Where was the action?

Auto stocks led the session on expectations of healthy monthly sales. Bajaj Auto jumped 2.30%, while M&M and Ashok Leyland gained on strong December numbers.

Financials stayed supportive, with Shriram Finance topping the Nifty gainers and extending its recent rally.

In the midcap space, JSW Energy, PNB Housing Finance, Astral and Supreme Industries advanced, while APL Apollo Tubes gained after strong Q3 volume updates.

On the downside, FMCG stocks underperformed, led by ITC’s sharp decline following an excise duty hike. PB Fintech slipped on regulatory concerns, while MCX saw some profit booking.

NIFTY50: Top Gainers

- SHRIRAMFIN ▲ +2.36%

- BAJAJAUTO ▲ +2.30%

- ETERNAL ▲ +2.07%

NIFTY50: Top Losers

- ITC ▼ -9.71%

- DRREDDYS ▼ -1.42%

- BAJFINANCE ▼ -1.39%

Open Interest Insights

Heavy call writing at 26,200 (60.23L) is creating a firm overhead resistance, while modest put additions at 26,000 (18.15L) keep the PCR-OI at 1.1.

What does this mean? With call writers aggressively positioned and limited put activity, the setup reflects a cautious sentiment rather than a strong directional bias.

Stocks on the Move

| Stock | % Gain / Loss | What’s happening? |

|---|---|---|

| AJANTAPHARM | +6.12% | Weekly double-bottom breakout above 2,862, supported by strong volumes |

| JSWENERGY | +4.05% | Breakout from consolidation, with momentum starting to build |

| GRANULES | +3.46% | Approaching a 52-week high; a move above 625 needed for follow-through |

| NTPC | +2.05% | Moving closer to the consolidation breakout zone near 342 |

| UNITDSPR | -2.74% | Rejected at the falling trendline, leading to a pause in momentum |

News You Can Use

- NMDC reports strong operational performance with production up 14.6% YoY and sales rising 18.7% YoY.

- December GST collections rise 6% YoY to ₹1.75 lakh crore.

- Cigarettes to attract 40% GST and higher excise duty; NCCD remains unchanged.

December Auto Sales Update

- Tata Motors CV sales jumped 25% YoY to 42,508 units.

- Tata Motors PV sales rose 14% YoY to 50,519 units.

- Ashok Leyland total sales surged 27% YoY to 21,533 units.

- Maruti Suzuki total sales climbed 22.2% YoY to 2.17 lakh units.

- M&M total sales grew 25% YoY to 86,090 units.

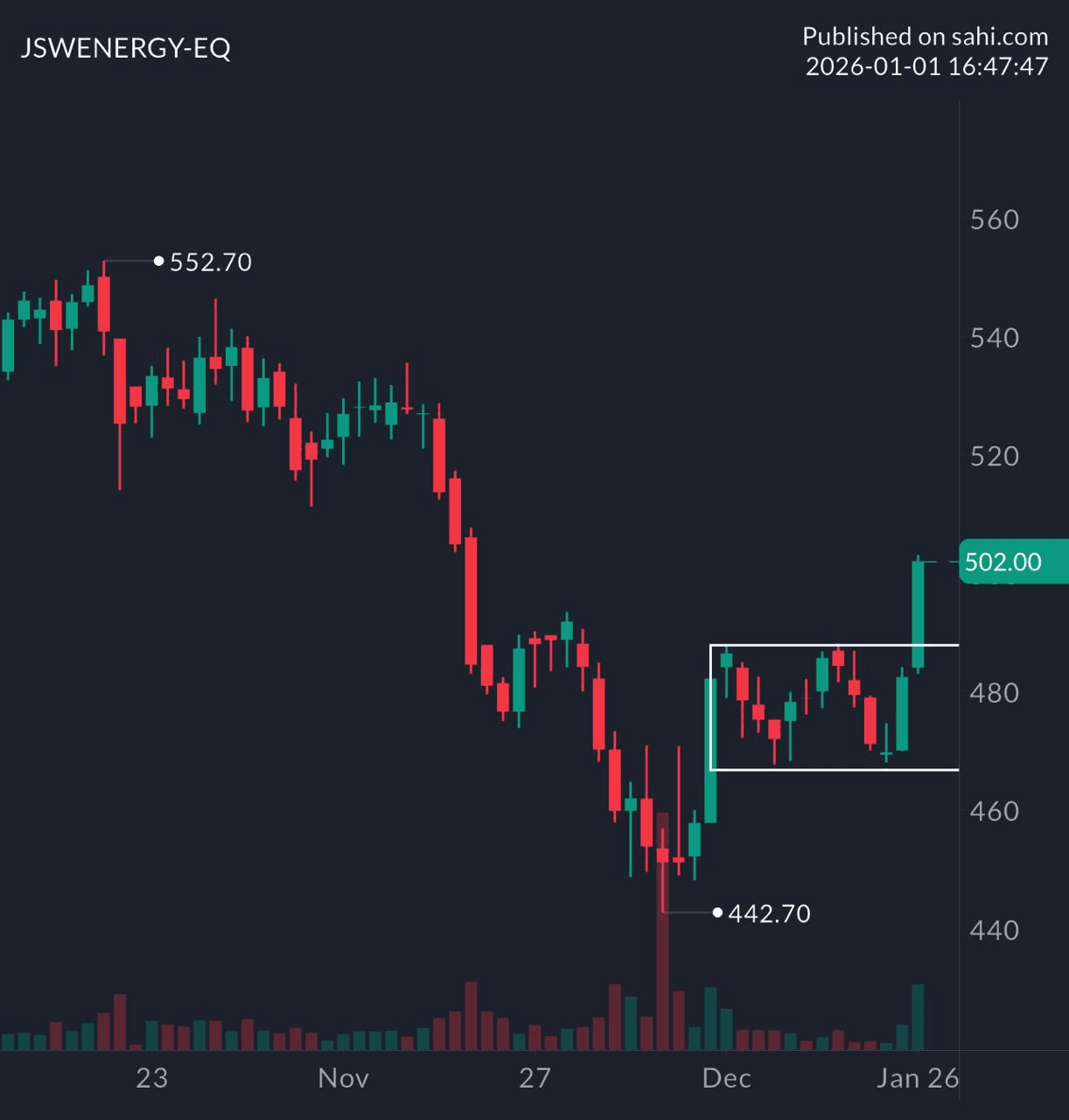

Chart of the Day: JSWENERGY (Daily Timeframe)

Spotted: Flag & Pole

Structure: A sharp impulsive move followed by a shallow consolidation, indicating a temporary pause after strong momentum.

Validation: A breakout above the flag boundary, ideally with volume expansion, confirms trend continuation.

Trading Insight: A classic continuation setup where brief consolidation often resolves into a quick, momentum-driven move in the direction of the prior trend.

Related

Recent

SEBI Regulation Margin Benefit Calendar: Expiry-Day Change for Single-Stock Spreads

RBI MPC February 2026: Repo Rate Held at 5.25% as RBI Prioritises Stability Over Fresh Easing

Indian Oil Q3 FY26 Results: Strong Earnings Momentum Driven by Refining Upswing and Government Support

Nykaa Q3 FY26 Results: Net Profit Surges 143% YoY to ₹63.3 Crore; Revenue Grows 26.7% to ₹2,873 Crore

PVR INOX Q3 FY26 Results: Reports Net Profit of ₹96 Crore; Revenue Jumps 9.7% YoY to ₹1,908 Crore