Markets take another knock: What happened today and what it means next

The Sensex and Nifty logged a third straight day in the red ahead of the Fed policy update. Market breadth stayed weak, with the NSE A/D at roughly 2:3. The Nifty failed to hold 25,800 and slipped toward the 50-DEMA, which coincided with the prior day low of 25,728. A slip below that opens the road toward 25,500. Any bounce is likely to run into stacked resistance zones near 25,875.

Bank Nifty is hovering near its key support at 58,800. A break below that level would put 58,650 and 58,300 into play. For the Sensex, structure is visibly weakening, with 84,050 - which aligns with the 50-DEMA - acting as the must-hold level.

Key levels to watch for December 11, 2025

| Index | Support | Resistance |

|---|---|---|

| Nifty | 25,700 & 25,550 | 25,875 & 26,965 |

| Bank Nifty | 58,650 & 58,300 | 59,200 & 59,400 |

| Sensex | 84,050 & 83,800 | 84,750 & 85,050 |

Sector & stock moves - what held up and what cracked

The Nifty Midcap 100 sank 1.12%, while the Smallcap 100 dropped 0.90%. Media, Metal, and Pharma were the rare pockets of green, even as IT, PSU Banks, Financials, and Private Banks dragged the indices lower. Midcap IT and Capital Market stocks extended weakness.

IndiGo fell after the regulator ordered a 10% cut in its winter schedule, while AU Small Finance Bank gained after the Finance Ministry cleared an increase in its FDI limit. Newly-listed names like Meesho and Aequs closed debut sessions with gains. Hindustan Zinc jumped as silver hit an all-time high.

Nifty50: Top Gainers

EICHERMOT - +1.48%

HINDALCO - +1.09%

HDFCLIFE - +1.07%

Nifty50: Top Losers

INDIGO - -3.26%

ETERNAL - -2.90%

TRENT - -1.64%

Open Interest insights

Call writers are aggressively guarding 25,900 (52.61L) and 26,000 (55.91L), while put writing stayed muted, showing up meaningfully only at 25,500 (25.53L). The PCR-OI currently stands at 0.5.

What does this positioning mean? It indicates a call-heavy market where upside attempts may face strong resistance. Overall, the setup reflects a cautious to bearish undertone.

Stocks on the move

| Stock | % Gain / Loss | What is happening? |

|---|---|---|

| HINDZINC | +4.31% | Consolidation breakout with resistance now shifting to 542 |

| ICICIPRULI | +3.09% | Contracting pattern breakout supported by strong volume; Golden crossover seen - SMA 50 above SMA 200 |

| AUBANK | +2.23% | Fresh all-time high after a narrow-range breakout backed by solid volume |

| AJANTPHARM | +1.27% | Follow-through buying after a retest of the breakout zone reinforcing the IH&S setup |

| PERSISTENT | -4.26% | Sharp sell-off accompanied by heavy short OI build-up |

News you can use

- Meesho soars 53.2% on debut as investors back its zero-commission, asset-light model.

- The Government directs IndiGo to cut 10% of planned flights after more than 2,000 cancellations last week.

- AU Small Finance Bank gains after the Finance Ministry approves raising its foreign investment limit to 74% from 49%.

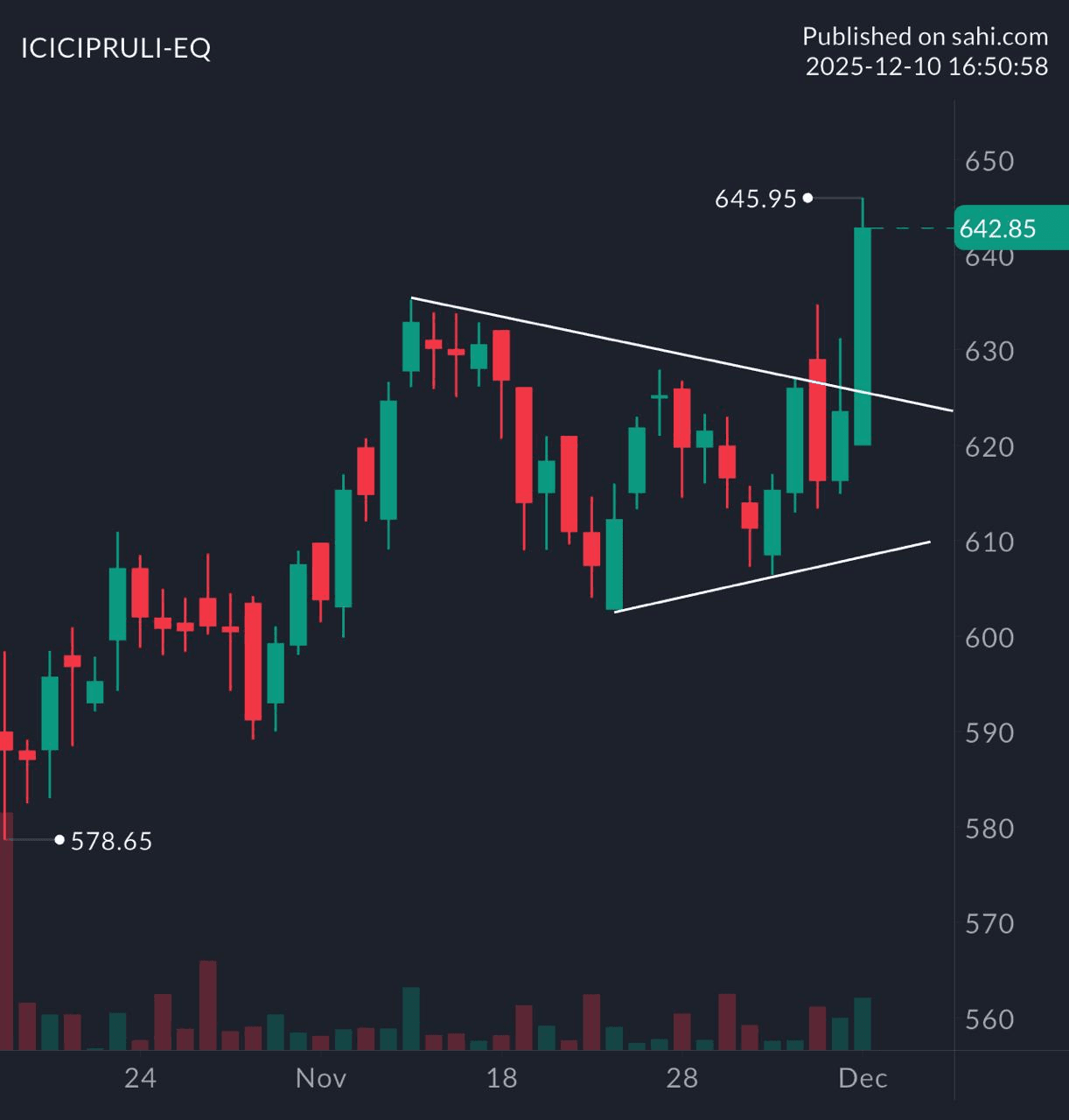

Chart of the day: ICICIPRULI (Daily TF)

Spotted: Pennant

Structure: A sharp impulse move followed by a contracting consolidation, showing the trend is pausing, not reversing.

Validation: A clean breakout above the pennant's upper trendline with sustained momentum confirms continuation.

Trading insight: This is a trend continuation pattern - once the breakout triggers, price often accelerates in the direction of the prior move.