Market Today: Nifty Ends Above 26,150 as Indices Close at Day’s High

Team SAHI

Market Today: A positive start to the week, What’s next?

The markets closed at the day’s high, supported by steady foreign inflows and upbeat global cues around potential US Fed easing. The Nifty ended above 26,150, while the Sensex added 638 points. Market breadth stayed firmly positive.

The indices are now approaching key decision zones. Nifty is inching closer to the 26,225 resistance, a level where rallies have previously struggled to sustain, while Sensex faces supply near 85,750. Bank Nifty remains constructive but is still below the 59,400–59,500 band; a clean break above this zone could open the path toward reclaiming prior highs.

Key Levels to Watch | December 23, 2025

| Index | Support | Resistance |

|---|---|---|

| Nifty | 26,050 & 25,980 | 26,225 & 26,325 |

| Bank Nifty | 59,150 & 58,935 | 59,400 & 59,700 |

| Sensex | 85,320 & 85,100 | 85,750 & 86,050 |

Sector & Stock Moves: Where the action was?

IT stocks led the charge for the fourth straight session, with Infosys, Wipro, and Persistent among the top gainers. Metals gained traction on the back of record-high Silver prices, while Auto and Pharma added depth to the rally. Defence stocks closed at the day’s highs.

MCX surged to an all-time high after regulatory commentary boosted sentiment around commodity derivatives. Hindustan Zinc climbed alongside the commodity rally, while Shriram Finance and Jupiter Wagons extended gains on stock-specific triggers.

NIFTY50: Top Gainers

- SHRIRAMFIN ▲ +3.68%

- TRENT ▲ +3.56%

- WIPRO ▲ +3.11%

NIFTY50: Top Losers

- SBIN ▼ -0.61%

- HDFCLIFE ▼ -0.61%

- KOTAKBANK ▼ -0.45%

Open Interest Insights

Strong put writing at 26,100 (1.73 Cr) and 26,000 (73.2L) indicates a well-defined support base. Call-side positioning remains relatively light, with limited additions at 26,300 (36.76L), keeping the PCR-OI elevated at 1.6.

What does this mean?

The setup reflects a bullish undertone with downside protection in the near term. Unless aggressive call writing emerges, the index is likely to hold supports and attempt a gradual move higher.

Stocks on the Move

| Stock | % Gain / Loss | What’s happening? |

|---|---|---|

| SOLARINDS | +5.95% | Strong support near 61.8% retracement, backed by volumes |

| MCX | +4.99% | Daily consolidation breakout to a new ATH |

| NATIONALUM | +4.24% | Continuation breakout with long OI build-up |

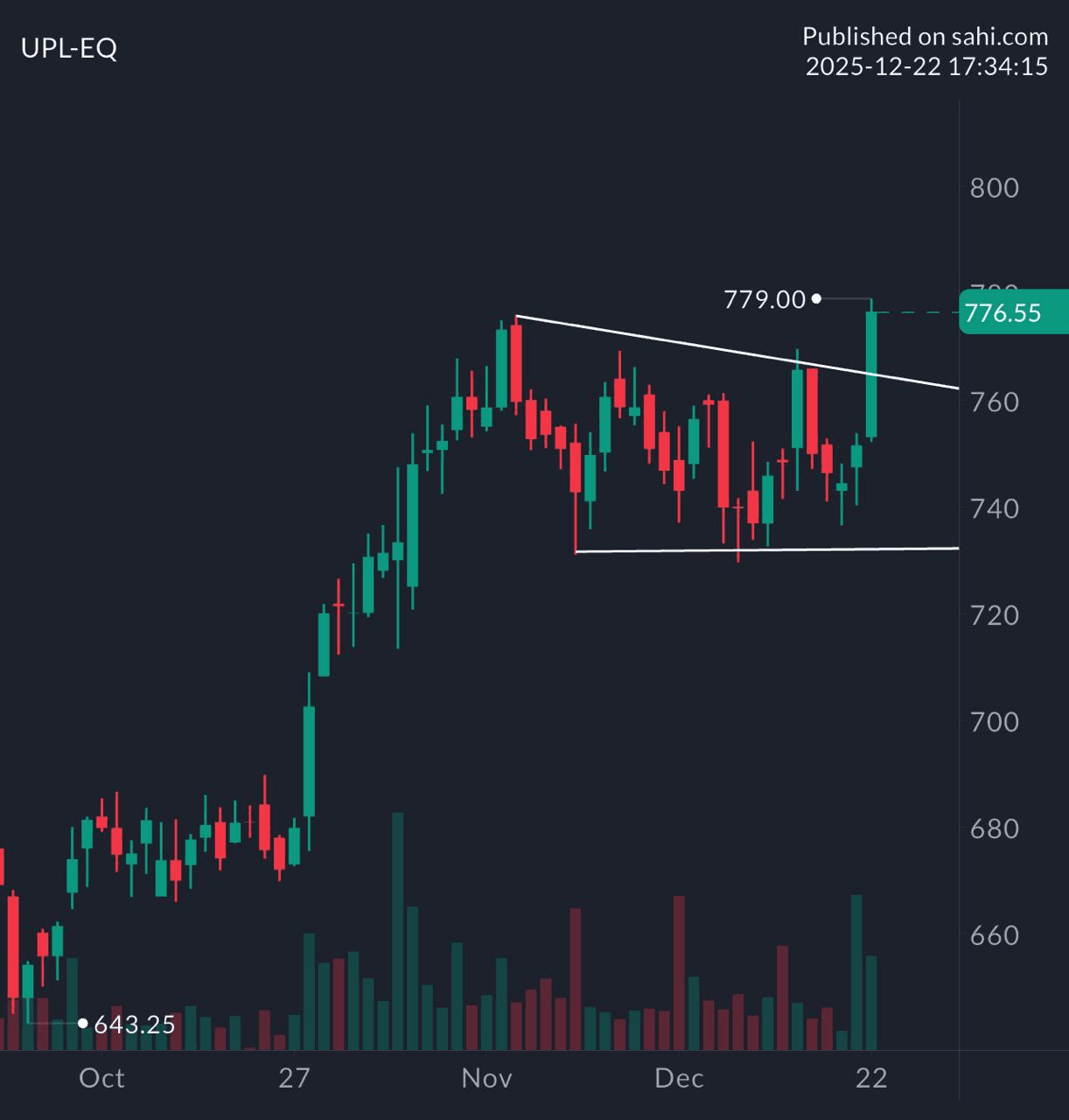

| UPL | +3.33% | Breakout above 765 with volume confirmation |

| CHOLAFIN | -3.83% | Break below triple-top neckline at 1,645 |

News You Can Use

- Ramco Cements sells non-core assets worth ₹515 crore to Prestige Estate Projects.

- Bondada Engineering bags ₹945 crore order from NLC India.

- HFCL shareholders approve fund raise via QIP.

- Dilip Buildcon wins 1,363.55 MW solar PV project under PM KUSUM, securing ₹4,900 crore EPC opportunity.

Chart of the Day: UPL (Daily TF)

Pattern Spotted: Descending Triangle

Structure: Lower highs with flat support, signalling consolidation within an ongoing trend.

Validation: A decisive breakdown below support with volume expansion confirms continuation.

Trading Insight: A classic continuation pattern, where sustained breaks often lead to strong follow-through in the direction of the prior trend.