Markets Slide as Nifty Breaks 26,000 | Midcaps See Worst Fall in 4 Months

SAHI

Nifty 25,960.55 ▼ -0.86%

Sensex 85,102.69 ▼ -0.71%

Bank Nifty 59,238.55 ▼ -0.90%

The Nifty couldn’t defend the 26,000 mark, with an overwhelming 46 of 50 stocks ending in red. Selling pressure wasn’t limited to the frontline names, Broader markets took it even harder. The Midcap index logged its worst decline in 4 months.

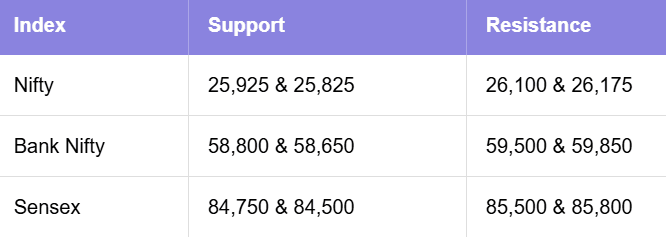

Nifty’s inability to hold the 20-DEMA and the 26,000 zone shows a clear loss of short-term momentum. The index now has immediate support at 25,825, and a break below this could open the doors to a deeper corrective wave. Bank Nifty holds a similar structure, with the critical support zone at 58,650–58,800, while the Sensex faces a key floor near 84,785.

PSU banks, Realty and Pharma were hit the hardest with Biocon slipping 2.25% after announcing plans to merge its biologics arm in a $5.5-billion deal. Life insurers were also weak following November business updates, dragging ICICI Prudential down.

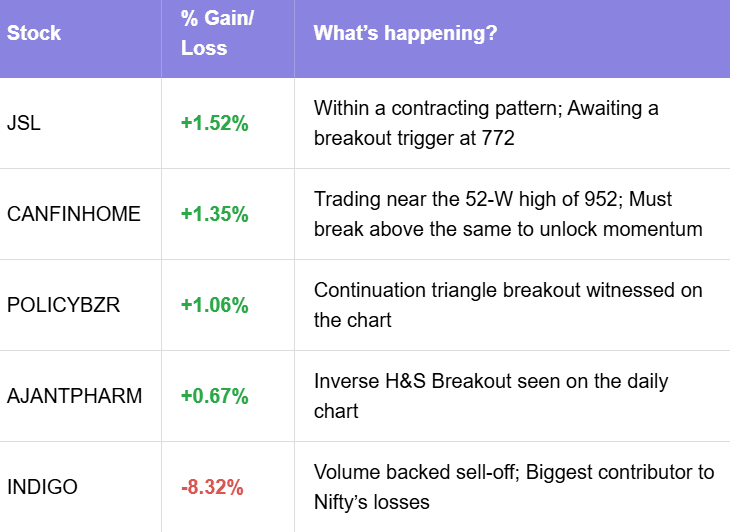

IndiGo crashed 8.32%, its steepest fall in four years, as operational disruptions overshadowed. Fino Payments Bank took a hit despite receiving RBI approval to turn into a small finance bank.

Niva Bupa gained 2.64% on a robust November update, and Ashoka Buildcon rose 2.45% after bagging a ₹447-crore BMC order.

TECHM ▲ +1.34%

WIPRO ▲ +0.57%

HCLTECH ▲ +0.33%

INDIGO ▼ -8.32%

BEL ▼ -5.04%

JSWSTEEL ▼ -3.71%

Call writers are strongly guarding 26,000 (1.66 Crore) and 26,100 (2.05 Crore) and 26,200 (1.64 Crore) while put writing was relatively subdued. The PCR-OI is at 0.5.

What does this mean? The setup signals a bearish, call-heavy market where upside moves may face strong resistance.

-

Adani Enterprises incorporated its wholly owned subsidiary Adani Airport City on December 6, 2025.

-

Eternal reports ₹1,535-crore block deal as 5.3 crore shares trade at ₹290.4 each.

-

Ashoka Buildcon: Company bags additional order worth ₹447 crore from BMC.

-

Biocon announces plan to merge its biologics unit in a $5.5 billion deal.

-

JSW Infra arm to acquire JSW Group rail units in a ₹1,212 crore deal.

-

HDFC Life board approves fundraise of up to ₹750 crore via NCDs.

Spotted: Falling wedge

Structure: Price keeps making LH’s and LL’s but the swings tighten as the two downward-sloping trendlines converge, showing selling pressure is fading.

Validation: Breakout above the upper trendline with clean momentum and ideally volume confirms the wedge.

Trading Insight: Once the breakout hits, the shift from compressed selling to fresh buying often sparks a sharp upside move.

That’s a wrap for today’s action-packed session! We’ll be back in your inbox on December 09, 2025, with more sharp insights, fresh trends, and signals from the markets.

Related

Recent

SEBI Regulation Margin Benefit Calendar: Expiry-Day Change for Single-Stock Spreads

RBI MPC February 2026: Repo Rate Held at 5.25% as RBI Prioritises Stability Over Fresh Easing

Indian Oil Q3 FY26 Results: Strong Earnings Momentum Driven by Refining Upswing and Government Support

Nykaa Q3 FY26 Results: Net Profit Surges 143% YoY to ₹63.3 Crore; Revenue Grows 26.7% to ₹2,873 Crore

PVR INOX Q3 FY26 Results: Reports Net Profit of ₹96 Crore; Revenue Jumps 9.7% YoY to ₹1,908 Crore