Market Minute | August 1, 2025

SAHI

Nifty: 24,565.35 ▼ -0.82%

Sensex: 80,599.91 ▼ -0.72%

Bank Nifty: 55,617.60 ▼ -0.62%

Rejected at the Top, Slipping at the Close!

Friday didn’t end well for the bulls. After a brief attempt to push higher at the open, the Nifty, Bank Nifty, and Sensex all got a firm rejection at their hourly EMAs — a signal that resistance is still very much in control.

By the end of the session, frontline indices were down ~1% each:

-

Sensex dropped 585 points to close at 80,600

-

Nifty lost 203 points to settle at 24,565

This marks the 5th consecutive weekly fall for Indian equities the longest losing streak in nearly 2 years. Over 35 Nifty 50 stocks ended the week in the red, with Adani Enterprises, Kotak Mahindra Bank, Wipro, Tata Motors, and Tata Steel leading the losers.

It wasn’t all bad FMCG came through with some shine: Hindustan Unilever, Jio Financial, L&T, Asian Paints, Trent, and Hero MotoCorp made it to the gainers list.

The broader markets fared worse than large caps:

-

Nifty Midcap 100: ▼ -1.30% today; ▼ -2.37% for the week

-

Nifty Smallcap 100: ▼ -1.66% today; ▼ -3.42% for the week

Sentiment remains weak across the board, with FMCG being the only relative safe haven.

Today’s sectoral heatmap was mostly painted red. The Nifty FMCG index rose 0.69%, led by Trent, HUL, and Asian Paints the calm in the storm.

On the flip side, Pharma took the biggest hit (▼ -3.33%) after Trump’s call for US drug price cuts spooked the street. Nifty Metals, Realty, IT, PSU Banks, and Auto also fell between 1.5%–2%.

-

Trent ▲ +3.23%

-

Asian Paints ▲ +1.46%

-

HUL ▲ +1.29%

-

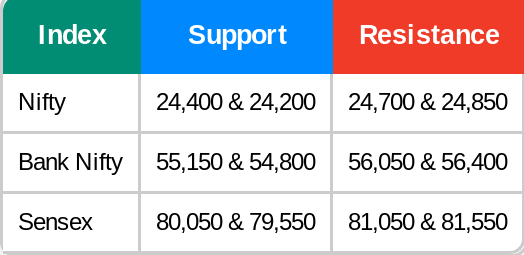

Call side: Highest OI at 24,800 CE (70.97L) — strong resistance; next at 24,700 CE (66.89L).

-

Put side: Highest OI at 24,200 PE (37L) — key support aligned with 200 EMA on the daily chart.

Corporate Updates

-

India’s manufacturing PMI rose to 59.1 in July (vs 58.4 in June)

-

Suzlon Energy gained over 5% on its F&O debut, aided by new wind turbine norms & a 381 MW FDRE order

-

L&T secured a fresh order worth ₹2,500–₹5,000 crore

-

Garden Reach Shipbuilders signed MoU with Germany’s Reintjes GmbH for marine propulsion tech

-

SEBI approved Quant Mutual Fund to launch India’s first SIF long-short fund

-

Coromandel Engineering bagged ₹134 crore in new work orders

-

Coal India’s output fell 15.5% in July

Q1 Earnings

-

Tata Power: Profit up 6% YoY to ₹1,262 crore; EBITDA up 17%

-

HUL: Net profit ₹2,732 crore; Revenue up 4% YoY to ₹15,931 crore

Pattern: Pennant

Structure: Forms after a sharp rally, price consolidates within converging trendlines forming a small triangle a pause before continuation.

Validation: Breakout above upper trendline with strong volume = bullish continuation.

Trading Insight: Suggests uptrend likely to resume post-consolidation.

That’s a wrap for today’s action-packed session.

We’ll be back again on August 4, 2025 with more sharp market insights and trade signals.

Until then, have a great weekend!