Why Trade Stock with Sahi?

Why Trade Stock with Sahi?

Got Questions? No Problem

Yes, Sahi is a SEBI-regulated trading platform and a Depository Participant (DP) that complies with all rules and regulations. We prioritize transparency and security, ensuring that you have complete visibility into pricing and other details. Your data is always protected with advanced security measures.

Opening a Sahi demat account is quick and hassle-free! It takes less than 10 minutes to complete the process. Once you submit your details, the exchanges will verify and approve your account, after which you can start trading and investing.

To open a demat account with Sahi, you need the following documents: Identity Proof: PAN card (mandatory). Address Proof: Aadhaar, Passport, Voter ID, or Driving License. Bank Proof: Cancelled cheque or bank statement. Income Proof: Salary slips, ITR, or bank statements (for trading in derivatives). Photograph: A recent passport-sized photo. Signature: A scanned copy of your signature.

Transferring shares to Sahi is simple. Follow these steps: 1. Register and log in to your current broker's platform or CDSL Easiest. 2. Navigate to the "Transaction" section and select "Setup". 3. Choose "Bulk Setup" and then "Transaction". 4. Enter the Execution Date and your Sahi Demat Account BOID (Beneficiary Owner ID). 5. Select the stocks (ISINs) you wish to transfer and click "Submit". 6. Verify the request and select "Commit". 7. Enter your CDSL Easiest PIN to complete the process. Your shares will be transferred to your Sahi demat account shortly.

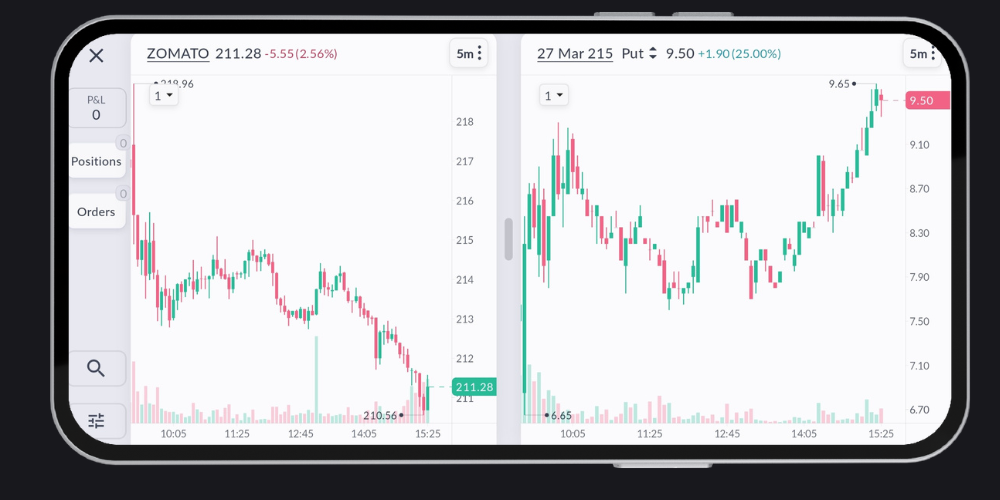

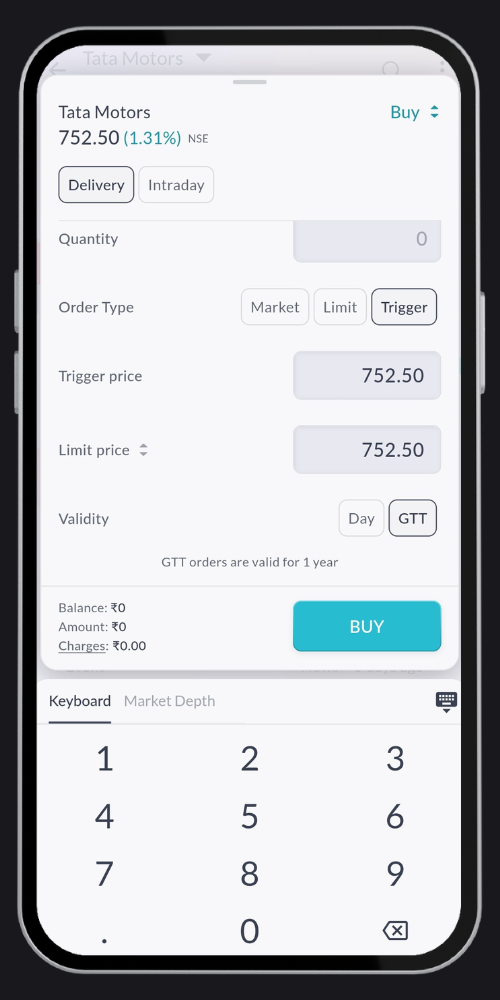

Yes, Sahi allows you to trade in stocks (Equity Delivery), Equity Intraday, Futures, and Options.

No, there is no minimum balance requirement to open a Sahi demat account. You can start trading and investing with any amount you're comfortable with.