Why Trade FnO with Sahi?

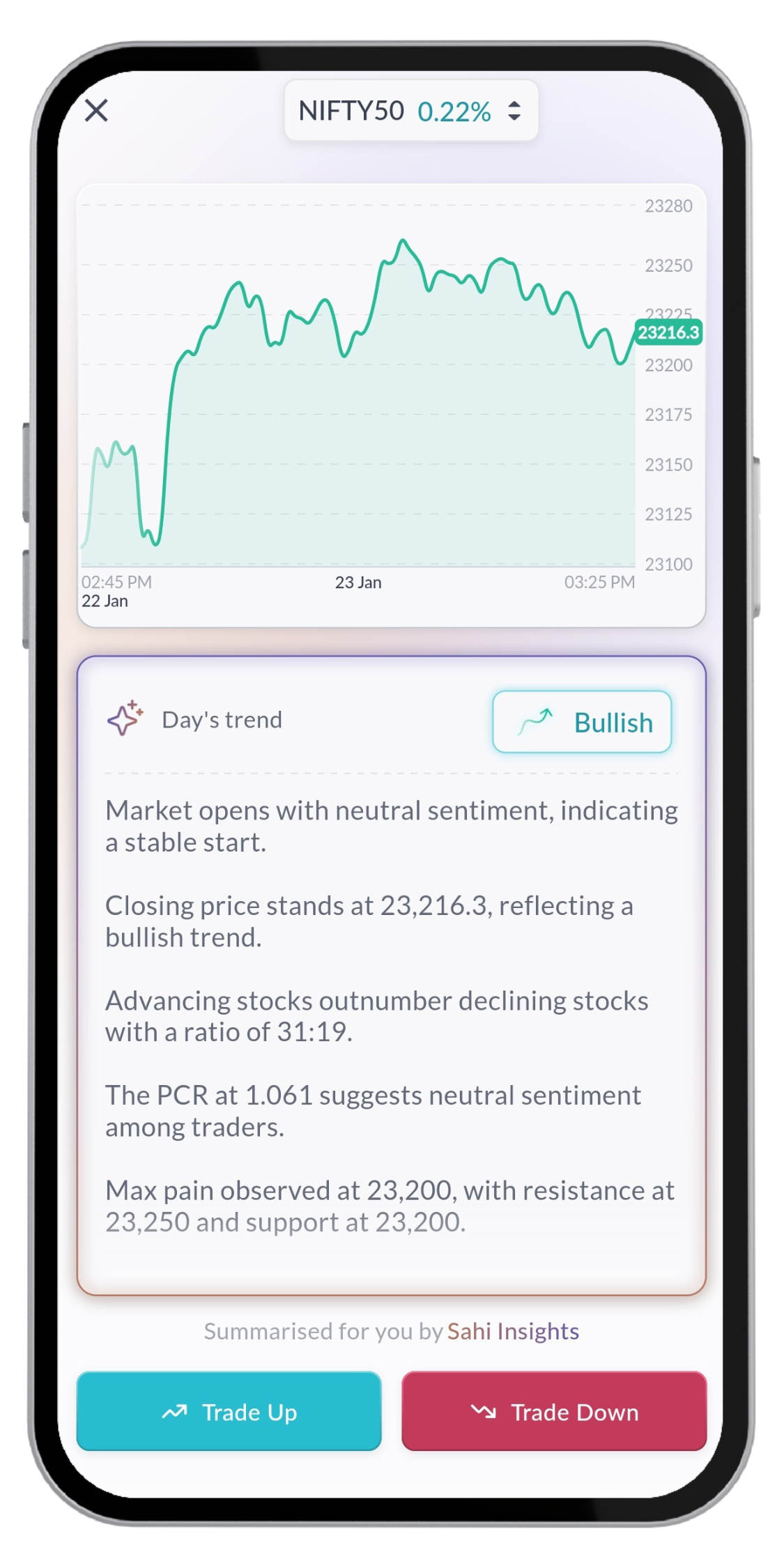

1-Click Chart Trading

Trade Stocks, Futures, and Options directly on Sahi Charts with just one click. Monitor your P&L, place orders, and manage exits—all from a single screen on your mobile.

Why Trade FnO with Sahi?

How to trade F&O with Sahi ?

The best way to get into trading is to find a platform you trust and learn

How to trade F&O with Sahi ?

The best way to get into trading is to find a platform you trust and learn

Got Questions? No Problem

Derivatives are financial contracts whose value is derived from underlying assets such as stocks, bonds, commodities, currencies, or market indices. They are used for hedging risks or speculative purposes.

Futures are standardized contracts where the buyer agrees to purchase, and the seller agrees to sell, a specific asset at a predetermined price on a future date. Both parties are obligated to fulfill the contract at expiration, regardless of the current market price.

Options give the buyer the right, but not the obligation, to buy (Call Option) or sell (Put Option) an underlying asset at a predetermined price (strike price) before or on the expiration date. The seller of the option is obligated to fulfill the contract if the buyer exercises their right.

There are two main types of Options: Call Option: Gives the buyer the right to buy the underlying asset at the strike price. Put Option: Gives the buyer the right to sell the underlying asset at the strike price.

The strike price is the price at which the buyer of an Option can buy (Call Option) or sell (Put Option) the underlying asset.

The expiration date is the last day on which the Option can be exercised. In India, monthly Options expire on the last Tuesday of the month, while weekly Options expire every Tuesday.