PhysicsWallah IPO Allotment Status: How to Check & Listing Date

SAHI

PhysicsWallah IPO subscription window closed on November 13, 2025, amid mixed but improving sentiment for new-age tech listings. The ₹3,480 crore IPO, comprising a ₹3,100 crore fresh issue and a ₹380 crore OFS, was priced in the ₹103–₹109 per share range.

A strong surge in QIB participation on the final day helped the issue sail through, even as retail and NII interest remained moderate. The allotment finalisation date is November 14, 2025, and the stock is scheduled to list on November 18, 2025 on both NSE and BSE.

Investors are watching this listing closely, as PhysicsWallah’s FY25 numbers suggest improving fundamentals and a more sustainable hybrid (online + offline) model.

-

Visit the BSE IPO Allotment Status page

-

Select ‘Equity’ under Issue Type

-

Select ‘PhysicsWallah Ltd’ in Issue Name

-

Enter Application Number or PAN

-

Click ‘Submit’

-

Visit the NSE IPO Allotment page

-

Choose ‘Equity’ and then ‘PhysicsWallah Ltd’

-

Enter PAN or Application Number

-

Click ‘Submit’

-

Visit the MUFG Intime India website

-

Select ‘PhysicsWallah Ltd’ from the IPO dropdown

-

Enter PAN, Application Number, or DP/Client ID

-

Click ‘Submit’

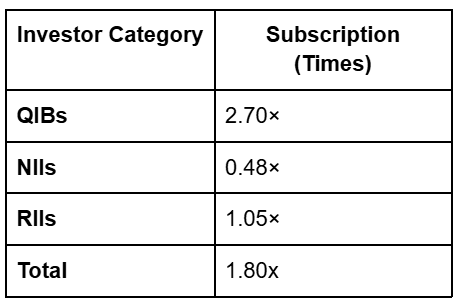

IPO Subscription Status (Final Day)

The issue saw subdued demand from retail and HNIs, with QIBs accounting for most of the overall subscription.

PhysicsWallah is an edtech unicorn providing affordable learning across JEE, NEET, UPSC, and K–12, supported by a powerful hybrid strategy combining digital content, YouTube reach, and a rapidly scaling network of offline Vidyapeeth centres.

In FY25, the company reported revenues of ~₹3,039 crore, marking 49% YoY growth, while losses narrowed sharply through offline scale and tighter cost control. Offline centres now contribute nearly half of total revenue, improving stability and unit economics. The company also secured ₹1,562.85 crore from anchor investors, reflecting selective but notable institutional conviction.

Related

Recent

Zomato Share Price Falls for 8 Straight Days. What's Really Going On?

Why Holi Flight Prices in 2026 Are Up 185% — And What's Really Behind the Surge

MCX Gold: Meaning, Contract Details, Trading Rules and Outlook in India

RFC OFS: Find Out the Main Reasons Behind the Stake Sale

Defence stocks rally as Indian PM visits Israel: what's driving the buzz