Ratio Spread Options Strategy

In the fast-moving world of options trading, we look for balanced strategies. The options strategies ratio spread is one effective way of managing. It helps us handle the challenges of complex options strategies while still having a good return on investment. Knowing how to get to ratio spreads opens opportunities for using strong strategies in trades.

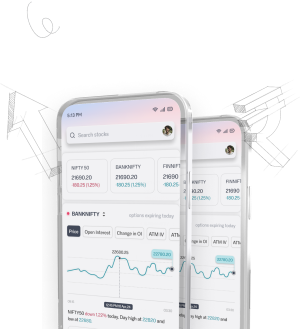

Ratio spreads imply that we do not have equal long and short options contracts. A trader might opt for a 2:1 setup. This would mean two long contracts versus four short ones. This affords us with a particular advantage in trading options. Having tools like the Sahi Trading app makes mobile trading easy. It simplifies trading and shows how advanced strategies like ratio spreads can be used.

Understanding the Basics of Ratio Spreads

Ratio spreads represent a smart way of using options in trading. We become much richer and can manage the risks better. When making use of the ratio spread, we buy as well as sell different options contracts simultaneously. It is normally seen to have a contract ration of 2:1. Thereby, for every one we sell, we buy two, which balances our view of the market.

There are two different types of ratio spreads: call and put. A call ratio spread is when we buy one out-of-the-money or at-the-money call and sell two more out-of-the-money calls. The put ratio spread is the same, but happens with puts instead. Here, we buy an out-of-the-money or at-the-money put and sell two more out-of-the-moneys. All these strategies force us to think along a certain aspect of how the asset will move. Profit and loss are both limited.

These spreads are interesting because they apply good options spread strategies. They work well in terms of time decay and volatility. Although they may require more margin, they also cost less at the beginning. This makes them attractive if one expects a probable profit.

But knowing what's at risk will help. If the price of our asset moves a lot, it will be hard to sell our options at a good price. Nevertheless, ratio spreads are flexible. We can change our stance by buying more or selling more contracts if the market shifts. All these key points will enable us to trade better.

What is the Ratio Spread Options Strategy?

The option ratio spread is quite an interesting way to trade with options. In this setup, you buy one option and sell several at a different price. This balance works towards our benefit. It's based on the prediction of how an asset's price will move. I buy a call at low price and sell calls at a higher price in the case of a call ratio spread. It helps us reduce costs and make money if we believe that the asset's price is going to rise a little. It's a good way for handling risks. A put ratio spread involves buying a put and selling some. It's good for us if we are thinking that the price is going to drop slightly, low level of risk, and high profit generation potential. Each of these is an opportunity in itself and based on the market. This strategy attracts various reasons. We can earn from the differences in premiums and have a flexible plan. However, there are downsides like possible high fees and complexity. Knowing this helps us make better choices.

| Strategy Type | Characteristics | Market Outlook |

|---|---|---|

| Call Ratio Spread | Buy 1 OTM call, sell 2 higher calls | Mod Bullish |

| Put Ratio Spread | Buy 1 OTM put, sell 2 lower puts | Limited Bearish |

| Front Ratio Spread | 1 option bought, 2 options sold | Several |

| Back Ratio Spread | More bought than sold option | High reward potential |

Looking into the options strategies ratio spread gives us confidence. It helps us understand the options market better.

The components of the ratio spread:

The key strategy in options trading is called ratio spreads. Ratio spreads combine buying and selling options. This allows us to use our positions effectively. We need to choose the right options, strikes, and expiry dates.

In a ratio put spread, we buy more puts at the higher strike price. We sell fewer puts at a lower strike price. We pay some amount upfront but our loss can't go more than that. Ratio spreads can make a lot of profit. If the stock price drops below our long puts' high strike, we could earn a lot. The strategy aims to profit from a moderate stock price drop.

Long put options would cover our investments from a big fall. Selling short puts brings money in, but if the option is exercised, we have to buy the stock. Therefore we should think over it carefully.

The choice between a ratio call or put spread is based on the same basics. They offer one of the greatest flexibilities but may be complex for newbies. Understanding ratio spreads would therefore help us better align our strategies and goals.

Advantages of Options Strategies Ratio Spread

The big advantage of ratio spreads in options investing is they bring together low costs, reduced risk, and the potential for profit. It's a compelling option in our trading toolkit.

Lower Cost of Entry

More money up front is needed for ratio spreads. That is good for us tight-wallet types. It lets more people get into options with less money.

Reduced Risk Exposure

This approach mixes options for buying and selling to cut risks. It protects us against sudden market changes. We, therefore can trade more calmly without fearing big losses.

Higher Probability of Profit

We have a better chance to make money with ratio spreads. Selling more options than we buy helps, even if the market doesn't do what we expect. This strategy gives us a boost in our odds of winning in options investing.

Creating a Ratio Spread

That involves careful thought and a deep knowledge of options strategies ratio spread. Options to use must match our market outlook and trading aims.

Selecting the Right Options

The first step in our ratio spread strategy is picking the right options. Here's what to keep in mind:

Search for underlying assets likely to cause movement based on market trend.

-

Look at the options' implied volatility; high volatility means better premiums.

-

The expiration dates should fall within our trading schedule to enjoy the profit.

Determining the Ratio

Let's figure out the right contract ratio, remembering our risk tolerance level. The risk/reward ratio used with put ratio spreads is often the 2:1 kind. For example: one may buy one long put at a higher strike and sell two lower ones. This will let us earn more premium than we spend on the long put.

| Transaction | Strike Price | Premium ($) | Net Credit ($) |

|---|---|---|---|

| Buy Long Put | 70 | 6 | 1 |

| Sell 2 Short Puts | 65 | 3.50 each |

After selling two 65 puts for $3.50 each and buying a 70 put, we get $1 credit. Remember to figure out our breakeven point, here it's $59. It's key to know when we'd buy stocks for less than their market value.

By using these methods, we can make ratio spreads that fit our trading plan and market views. ## Real-life Examples of Successful Ratio Spreads

Let's consider how a ratio spread may operate in real examples. A trader smartly used the Bullish Call Ratio Spread. He bought one call option and sold two at a higher price. In this way, he dramatically reduced the start-up cost. Moreover, he had the opportunity to enjoy even a small price rise of an asset.

The trader used an 1:2 ratio tactics in trading stock AZO using 80 (short) and 60 (long) delta calls. He wanted to use the expected rise in volatility before news on the earnings. That tactic created a strong position and provided the chance to win big if the stock rises before the earnings report. The trader looked at past earnings using special tools to tweak delta values, and with that, he toned up his strategy to be even more intense.

In yet another example, a trader set up a bull call spread with a stock at $50. He exchanged for an at-the-money call at $3 and an out-of-the-money call at $2. That was a wise mixture, having emerged with a low cost of $100. However, that opened the door to a big win of $400. The prime choice of $51 breakeven shows the value of timing.

Good controls on risks, such as stop-loss orders and watching closely to withdraw from this or that situation, enabled these traders to ride through ups and downs. They monitored changes in volatility and fine-tuned their strategies to stay ahead. This active stance helped them increase their trading success.

Best Practices in Deploying Ratio Spread Strategies

The best practice in options trading, especially ratio spreads, can be achieved through the key success aspect-success more. Maintaining market watch is very important. Monitoring trends can help make intelligent decisions about a trade. Thence, economical news and firm's updates need to be kept in mind as well. This may help pick up the right times to use our options strategies.

And most importantly, we have to time our trades correctly. We have to be cautious but not so impatient. Trading on a bull put spread in the presence of low market volatility, for example, may do good to us. We can then get better premiums. Re-making our plan according to the way the market moves will make us more remunerative. This way, we would be allowed to change our strategies when required.

We should learn and be able to adapt every day. Tools such as Sahi Trading make our trades faster and better. We can make the most of ratio spreads if only we continue learning and hence tweaking their tactics. This will help us do even better in the fast-paced world of options trading.

Disclaimer

The content provided is for educational purposes only and does not constitute financial advice. For full details, refer to the disclaimer document.