Nifty Expiry Day, Weekly Expiry Days in NSE

National stock exchange is the leading stock exchange in India, which uses the nifty 50 index to analyze the market conditions. In general scenario expiry date means date after which product or services is no longer available for use and in case of market also there is an expiry date. The idea of weekly expiry is very important in the Indian stock market. This market has high liquidity and an active derivatives section. The National Stock Exchange of India (NSE) on Tuesday announced that it offers weekly expiry options for different indices, like Nifty Futures. These weekly expiries usually happen on Thursdays.

What are Expiry Days in F&O Markets?

The expiry date in F&O trading indicates the timeline for executing or settling contracts. In India, stock and index futures and options typically expire on the last Thursday of the contract month. If this Thursday is a holiday, the expiry will be moved to the previous trading day. Expiry of F&O ensures all obligations are met and finalized through cash settlement or physical delivery. It keeps the market orderly and reduces risk. Without expiry date, contracts would last indefinitely, creating uncertainty and increasing the risk of market manipulation. The expiration date acts as a clearing mechanism, essentially sweeping the market clean of obligations and allowing for a fresh start.

Types of Expiry Days

Nifty has two type of expiry dates weekly and monthly

Weekly Expiry Date:

The weekly contracts expire every Thursday. Weekly expiries offer a lucrative opportunity for active traders. If the stock market is closed on a Thursday, the expiry day is the previous trading day. It is safe to trade options on the expiry day. Weekly expiries happen every Thursday.

Monthly Expiry Date:

Monthly expiry usually falls on the last Thursday of each month, with exceptions for holidays. If last Thursday is a trading holiday, the contracts expire on the previous trading day.

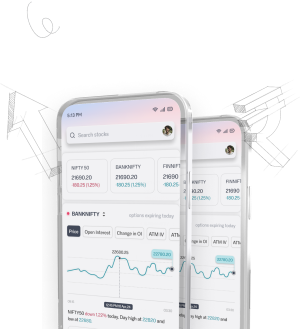

List of NSE weekly expiry days

There are four distinct contracts offered by the NSE that have weekly options expiring in the Indian markets. These contracts are MIDCAP NIFTY, FINNIFTY, BANK NIFTY, and NIFTY. Below are the weekly expiry days for each of these contracts.

| S.No. | Index | Date of Expiry |

|---|---|---|

| 1 | MIDCAP NIFTY | Every Monday |

| 2 | FINNIFTY | Every Tuesday |

| 3 | BANK NIFTY | Every Wednesday |

| 4 | NIFTY | Every Thursday |

MIDCAP NIFTY

The NIFTY Midcap 100 is a prominent stock market index in India that consists of the top 100 companies listed on the National Stock Exchange (NSE) in terms of market capitalization after excluding the NIFTY 50. It serves as a benchmark for tracking the performance of mid-sized companies in various sectors of the Indian economy. These companies are typically more established than small-cap stocks but still exhibit growth potential.

FINNIFTY

The Nifty Financial Services Index (FINNIFTY) tracks the performance of top companies in India’s financial sector on the National Stock Exchange (NSE). This index includes up to 20 leading firms from banks, insurance companies, and other financial services providers.

BANK NIFTY

This index exclusively tracks the performance of the top 12 public sector and private sector banks listed on the National Stock Exchange (NSE) of India. It serves as a benchmark for the banking industry, reflecting the overall health of the banking sector.

NIFTY

The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange.

What Happens on the Day of Expiry in the F&O Market?

Expiry day in the stock market refers to the date when derivative contracts, such as futures and options contracts, come to the end of their trading period. It is significant because traders must either settle their positions by exercising their contracts or allow them to expire. On the expiry date, the F&O contracts are settled, which means traders adjust their positions, resulting in high market volatility. The assessment of underlying assets influences pricing as the expiry date nears; coupled with traders’ adjustments, this leads to significant changes in stock prices.

Why Weekly Expiry Days Matter to Traders.

Volatility on Expiry Days

It has been commonly observed that during expiry days, there is a surge in market activity as traders rush to adjust their positions and this leads to increase in volatility and trading volume. This volatility in market can create profit opportunities but with risk.

Impact on Option Pricing

Settlement of a large number of options contracts on expiry day affects the overall market. This is because when many options contracts reach their expiry date, traders have to either buy or sell the underlying asset to settle their position. When it involves massive buying or selling in the asset, then the changes in its price and consequently the asset cause tremendous movements in the market.

Strategic Trading:

As the expiry date approaches, the time value of options decreases rapidly. This phenomenon, known as time decay or theta, intensifies in the final days, significantly affecting option prices. On expiry day, market liquidity changes when traders roll over their positions. Traders should focus on good execution strategies.

How Weekly Expiry Days Affect the Broader Market

Expiry day can cause sudden price movements and completely change the intrinsic value of assets. This price movement occurs due to speculative trading and the upcoming contract month and affects the market in various ways: Impact on Indices: Expiry days are often linked to more activity in the market. As the time for contract settlement gets closer, traders change their positions. They do this based on the market mood, news, and their views on the underlying asset. This rush can cause big price changes in index options, especially during the last hours of trading. Market Sentiment: These days often see increased trading activity and liquidity, which can lead to greater profit potential. Additionally, the expiry of options contracts on these days can result in increased volatility, creating more trading opportunities for those utilizing the Weekly Expiry Nifty.

Conclusion

Understanding expiry days is crucial for anyone trading F&O contracts in India. With the recent introduction of weekly expiry options, Indian markets offer exceptional flexibility for managing risk and capitalizing on short-term opportunities.

Disclaimer

The content provided is for educational purposes only and does not constitute financial advice. For full details, refer to the disclaimer document.